Swing Trading 2025: A Simple Strategy for Your First Profitable Trade

Thinking about getting into the stock market in 2025? While long-term investing is a great place to start, you might also be hearing a lot about swing trading. It sounds complicated, but it doesn't have to be. Unlike day trading (where you buy and sell in the same day), swing trading involves holding a stock for a few days to a few weeks to capture short-term price movements.

This post will walk you through a simple swing trading strategy that's perfect for beginners. We'll show you how to find potential trades and what signals to look for.

What is Swing Trading?

Imagine a stock price moving up and down in a wave. Swing traders try to ride one of those waves. They buy a stock when it's at a low point in a trend and sell it a few days later when it hits a high point. The goal isn't to hit a home run, but to make small, consistent profits.

The Simple Strategy: Riding the Moving Average

This technique is a favorite among new traders because it's straightforward and easy to see on a chart. We'll use two tools:

- The 50-Day Simple Moving Average (SMA): This line on a stock chart shows the average closing price over the last 50 days. It helps you see the stock's general trend.

- Candlestick Charts: These charts show the stock's price movements for a specific period (like one day) and are great for identifying turning points.

Here's the strategy in three simple steps:

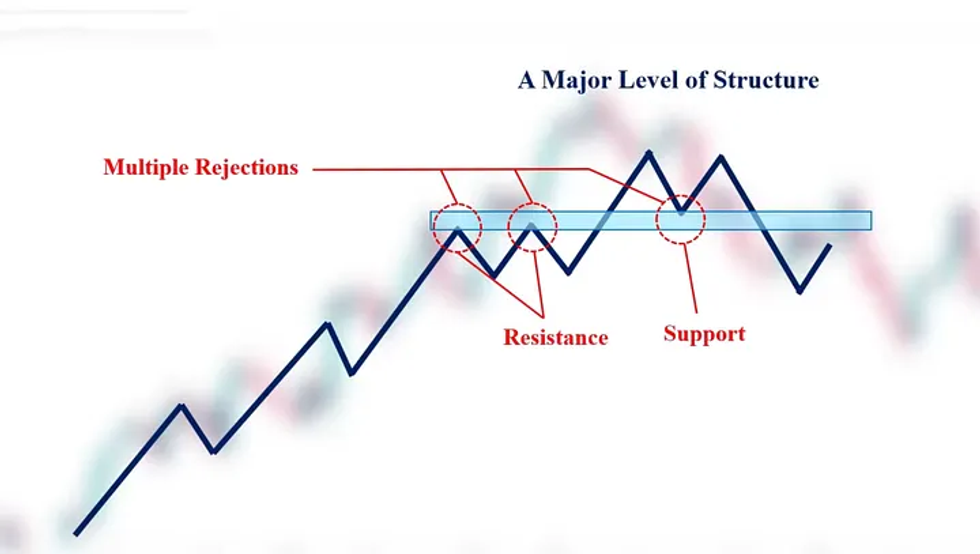

Step 1: Find a Trending Stock

First, you need to find a stock that is trending generally upward. A simple way to do this is to open a stock chart and add the 50-Day SMA. Look for a stock where the price is consistently trading above the 50-Day SMA. This is your "green light" that the stock is in an uptrend.

- Internal Link: For more on how to read charts, check out our guide: [The Beginner's Guide to Reading a Stock Chart].

Step 2: Wait for a Pullback

Even in a strong uptrend, stock prices don't go straight up. They pull back to rest before continuing the climb. For our strategy, we want to wait for the stock's price to drop and touch or come very close to the 50-Day SMA. This is your buying opportunity.

This is a key part of the technique: you are not buying at the peak; you are waiting for the price to become more attractive.

- External Link: For an in-depth explanation of moving averages, a great resource is Investopedia's article on the topic.

Step 3: Wait for a Rebound and Buy

Once the stock price has pulled back to the 50-Day SMA, you need one final signal. Wait for the next one or two candlesticks to show a rebound—meaning they are green and the price is moving back up. This indicates that the support at the moving average is holding and the trend is likely to continue.

Important Note on Risk Management

No strategy is foolproof. To protect your capital, always set a stop-loss order. This is an automatic order to sell your stock if its price falls below a certain point. A good rule of thumb is to set your stop-loss just below the 50-Day SMA. This limits your potential loss if the trend fails.

Ready to Try It?

This simple swing trading technique is a great way to start learning about short-term price movements without the pressure of day trading. As you get more comfortable, you can start exploring other indicators and strategies.

What questions do you have about getting started with swing trading? Share your thoughts below!